Commercial Real Estate: A Lucrative Investment Opportunity

Commercial real estate forms the backbone of the economy, encompassing various property types that serve business purposes. From office buildings to retail centers, industrial warehouses to multifamily complexes, commercial real estate plays a vital role in driving economic growth and facilitating business activities. In this article, we’ll explore the intricacies of commercial real estate, its investment potential, associated risks, and the steps to navigate this dynamic market.

Types of Commercial Real Estate Properties

Office Spaces

Office buildings serve as headquarters for businesses, ranging from small startups to multinational corporations. These properties vary in size, amenities, and location, catering to diverse tenant needs.

Retail Spaces

Retail properties include shopping malls, strip centers, and standalone stores where goods and services are sold to consumers. Location and foot traffic are crucial factors influencing the success of retail investments.

Industrial Spaces

Industrial real estate comprises warehouses, distribution centers, and manufacturing facilities. With the rise of e-commerce, demand for industrial properties has surged, driven by the need for efficient logistics and supply chain operations.

Multifamily Properties

Multifamily real estate consists of apartment complexes, condominiums, and townhomes designed to accommodate multiple households. The rental market remains robust, making multifamily properties an attractive investment option for steady cash flow.

Hospitality Properties

Hospitality real estate includes hotels, resorts, and motels catering to travelers and tourists. This segment is highly sensitive to economic fluctuations and seasonal demand patterns.

Factors Influencing Commercial Real Estate

Various factors influence the performance of commercial real estate assets, including economic conditions, location, market trends, and demographics. Economic growth, job creation, and population growth contribute to increased demand for commercial properties in thriving markets.

Benefits of Investing in Commercial Real Estate

Potential for Higher Returns

Commercial real estate offers the potential for higher returns compared to residential properties, especially in prime locations with strong tenant demand.

Portfolio Diversification

Investing in commercial real estate allows investors to diversify their portfolios and reduce overall risk by spreading investments across different asset classes.

Tax Advantages

Commercial real estate investors benefit from various tax deductions, including depreciation, mortgage interest, and property taxes, which can significantly lower the tax burden.

Appreciation Potential

Commercial properties have the potential to appreciate over time, generating wealth for investors through capital appreciation.

Risks Associated with Commercial Real Estate

Economic Downturns

Commercial real estate is vulnerable to economic downturns, which can lead to declining property values, increased vacancies, and financial instability.

Vacancy Rates

High vacancy rates pose a significant risk to commercial property investors, as vacant spaces result in loss of rental income and increased carrying costs.

Property Management Issues

Effective property management is essential for maintaining tenant satisfaction, addressing maintenance issues promptly, and maximizing property performance.

Regulatory Changes

Changes in zoning regulations, building codes, and environmental laws can impact the value and feasibility of commercial real estate projects.

Steps to Investing in Commercial Real Estate

Investing in commercial real estate requires careful planning and due diligence to mitigate risks and maximize returns.

Conducting Market Research

Thorough market research helps investors identify emerging trends, assess demand-supply dynamics, and evaluate competitive properties.

Financial Analysis

Analyzing financial metrics such as cash flow, cap rate, and return on investment (ROI) helps investors assess the profitability and viability of commercial real estate investments.

Property Inspection

Physical inspections allow investors to assess the condition of the property, identify potential maintenance issues, and estimate repair costs.

Closing the Deal

Closing the deal involves negotiating purchase terms, securing financing, conducting legal due diligence, and completing the transaction.

Commercial Real Estate Financing Options

Traditional Loans

Traditional bank loans offer competitive interest rates and terms for financing commercial real estate acquisitions and developments.

SBA Loans

Small Business Administration (SBA) loans provide financing options for small businesses seeking to purchase or refinance commercial properties.

Commercial Mortgage-Backed Securities (CMBS)

CMBS loans pool together commercial mortgages and sell them as securities to investors, providing liquidity to the commercial real estate market.

Private Equity Funds

Private equity funds invest in commercial real estate projects, providing capital in exchange for equity ownership or debt securities.

Emerging Trends in Commercial Real Estate

Technology Integration

Advancements in technology, including smart building systems, data analytics, and virtual reality, are transforming the way commercial properties are managed and operated.

Sustainable Development

Sustainability initiatives such as green building certifications, energy-efficient designs, and renewable energy sources are gaining traction in commercial real estate development.

Co-Working Spaces

The rise of co-working spaces and flexible office arrangements is reshaping the commercial real estate landscape, catering to the evolving needs of remote workers and entrepreneurs.

Adaptive Reuse Projects

Adaptive reuse projects involve repurposing existing buildings for new uses, such as converting warehouses into loft apartments or historic buildings into boutique hotels.

Conclusion

Commercial real estate offers investors an array of opportunities to generate income, build wealth, and diversify their investment portfolios. By understanding the market dynamics, conducting thorough due diligence, and staying abreast of emerging trends, investors can navigate the complexities of commercial real estate successfully.

FAQs (Frequently Asked Questions)

- Is commercial real estate a good investment?

- Commercial real estate can be a lucrative investment option, offering potential for higher returns and portfolio diversification.

- What are the risks of investing in commercial real estate?

- Risks associated with commercial real estate include economic downturns, vacancy rates, property management issues, and regulatory changes.

- How do I finance a commercial real estate investment?

- Financing options for commercial real estate include traditional loans, SBA loans, CMBS loans, and private equity funds.

- What are some emerging trends in commercial real estate?

- Emerging trends in commercial real estate include technology integration, sustainable development, co-working spaces, and adaptive reuse projects.

-

How can I mitigate risks when investing in commercial real estate?

- Mitigating risks involves conducting thorough due diligence, diversifying investments, and staying informed about market trends and regulatory changes.

You May Also Like

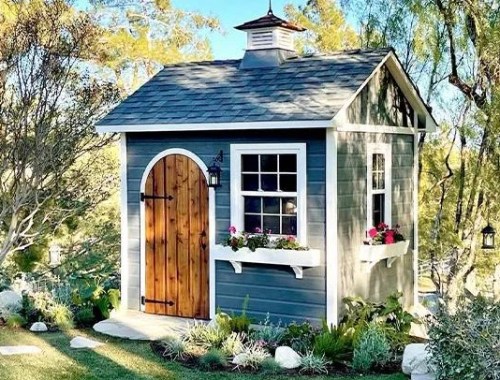

Exploring the Versatility and Practicality of Garden Sheds

May 1, 2024

Choosing the Right Patio Furniture for Your Outdoor Space

February 10, 2024